Get This Report on Medicare/ Medicaid In Toccoa, Ga

Functioning does boost the possibility that one and one's family participants will certainly have insurance, it is not an assurance. 1 percent uninsured price) (Hoffman and Pohl, 2000).

New immigrants account for a substantial percentage of individuals without health insurance. The partnership between health insurance policy and accessibility to care is well established, as recorded later in this phase. The connection between wellness insurance and wellness results is neither straight nor simple, a considerable scientific and health solutions research literary works links wellness insurance policy protection to better access to care, far better high quality, and boosted personal and population wellness condition.

Not known Incorrect Statements About Health Insurance In Toccoa, Ga

The problems encountered by the underinsured remain in some respects comparable to those dealt with by the uninsured, although they are usually much less severe. Uninsurance and underinsurance, nonetheless, include distinctly various policy concerns, and the methods for addressing them might differ. Throughout this research study and the 5 reports to adhere to, the primary emphasis is on individuals without any medical insurance and hence no support in paying for wellness care past what is readily available with charity and safety internet organizations.

Medical insurance is a powerful variable impacting receipt of treatment since both clients and physicians respond to the out-of-pocket rate of services. Medical insurance, nonetheless, is neither needed nor enough to get access to clinical services. However, the independent and direct effect of medical insurance protection on access to wellness services is well developed.

Others will certainly obtain the health and wellness treatment they need even without medical insurance, by spending for it expense or seeking it from service providers that offer care complimentary or at very subsidized prices - Annuities in Toccoa, GA. For still others, medical insurance alone does not guarantee receipt of care due to various other nonfinancial obstacles, such as an absence of healthcare carriers in their community, minimal accessibility to transport, illiteracy, or etymological and social distinctions

Little Known Questions About Final Expense In Toccoa, Ga.

Official research about without insurance populaces in the USA dates to the late 1920s and early 1930s when the Board on the Cost of Treatment generated a collection of reports concerning funding physician office gos to and hospital stays. This concern became salient as the numbers of medically indigent climbed up throughout the Great Clinical depression.

Empirical studies regularly sustain the web link in between accessibility to care and boosted wellness end results (Bindman et al., 1995; Starfield, 1995). Having a regular source of care can be thought about a forecaster of accessibility, as opposed to a direct step of it, when health and wellness results are themselves utilized as gain access to signs. Automobile Insurance in Toccoa, GA. This expansion of the idea of access measurement was made by the IOM Board on Monitoring Access to Personal Healthcare Services (Millman, 1993, p

However, the influence of moms and dads' wellness and medical insurance on the well-being of their youngsters has actually gotten interest only recently. Whether parents are guaranteed shows up to impact whether or not their children receive treatment in addition to exactly how much careeven if the children themselves have insurance coverage (Hanson, 1998).

Some Ideas on Medicare/ Medicaid In Toccoa, Ga You Should Know

Although emergency departments are portrayed as a pricey and unacceptable site of health care solutions, lots of uninsured clients seek treatment in emergency departments since they are sent there by various other healthcare carriers or have no place else to go. Emergency treatment experts argue that the country's emergency divisions not only offer as companies of last option yet are an important entry factor into the wellness care system (O'Brien et al (https://www.tripline.net/trip/Thomas_Insurance_Advisors-62200000170310239F07D4AA67931B3D?n=27)., 1999)

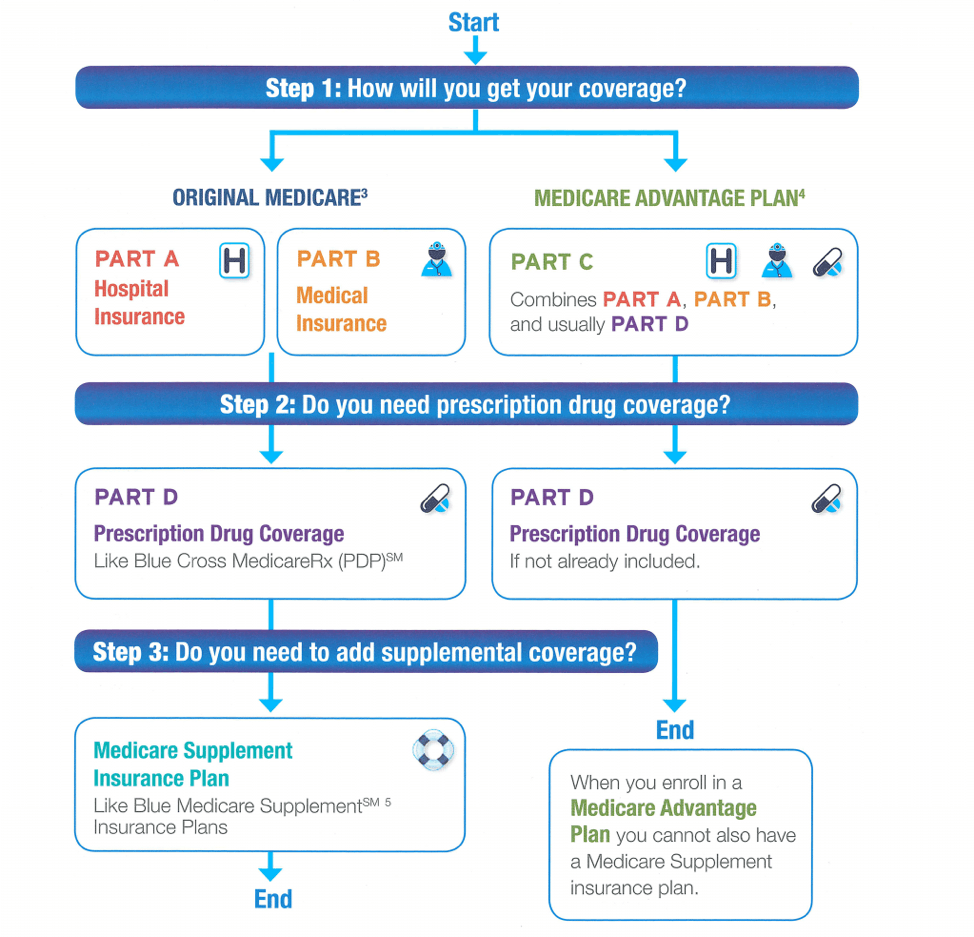

Chapter 2 supplies an overview of exactly how employment-based medical insurance, public programs and specific insurance plan operate and communicate to supply substantial however incomplete protection of the U.S. population. This includes a testimonial of historic fads and public laws impacting both public and personal insurance, a discussion of the communications amongst the various sorts of insurance, and an evaluation of why people relocate from one program to one more or wind up with no coverage.Chapter 3 synthesizes existing details to get to a composite summary of the uninsured: What qualities do individuals without insurance coverage typically share? Where do the without insurance real-time? The chapter additionally offers info about the threat of being or ending up being uninsured: How does the opportunity of being uninsured adjustment depending upon picked attributes, such as racial and ethnic identity, country or urban residency, and age? What are the chances for certain populations, such as racial and ethnic minorities, country citizens, and older working-age individuals, of being uninsured? Just how does the possibility of being without insurance modification over a life time? In addition to defining the likelihood of being without insurance in terms of a solitary measurement, such as gender, age, race, job condition, or geographical region, Phase 3 Offers the results of multivariate helpful resources analyses that use a more interesting depiction of the factors that add to the chances of being without insurance.

:max_bytes(150000):strip_icc()/what-will-a-good-financial-planner-do-for-me-2388442_color2-566eaab6a87b463d951130f508b5aa3e.png)